In June 2023, a 6.3-magnitude earthquake hit Batangas.[1] Meanwhile, from January to April 2023, over 50,000 road accidents in the country were recorded, leading to at least 1,499 deaths.[2]

These events and figures show that the road is full of uncertainties. You may be a careful motorist, but factors beyond your control—such as natural disasters, out-of-shape roads, and kamote drivers—lead to accidents. There’s also the possibility that you can cause accidents yourself.

But there should be nothing to worry about if you have a car insurance policy. It’s your responsibility as a driver to know the types of car insurance claims so that when the time comes, you’ll know what to do. This will help fast-track the entire claim process.

What are the Common Situations Requiring You to File a Car Insurance Claim?

A lot can happen on the road. Here are some situations that may compel you to file a claim.

🚗 Necessary Car Repairs Caused by an Accident

The damage your car sustained in an accident, whether through your fault or not, will definitely burn a hole in your pocket. But if you delay the repair, the more it'll cost you, especially if you’re using the vehicle to make money.

To cover the costs while also protecting your savings, tap into your car insurance. Depending on the type of coverage and the situation you’re in, you can also use your insurance to have your car towed to an accredited repair shop.

🚗 Physical Injury or Death

If your car hits another person and the incident results in injury or death, turn to your insurance contract to see how this will be covered. This is the first thing that you should do, especially if you have a comprehensive car insurance policy.

Similarly, you can file a claim if your passenger gets injured or dies from the accident. In the same vein, you can file a claim if you’re injured. In the case of your death, your family can avail of the insurance benefits.

🚗 Damage to Property

Sometimes, it’s the non-living things—such as business establishments, houses, and other cars—that get involved in accidents. Avoid legal repercussions by covering the cost of repairs with the help of your car insurance.

🚗 Total Loss

If your car is damaged beyond repair, get it assessed to find out if it’s a total loss. A car is usually considered a total loss or total wreck when the cost of its repair is higher than its current value. You can invoke total loss if your car insurance policy in the Philippines has this type of coverage.

🚗 Natural Disasters

From typhoons to earthquakes and flash floods, the Philippines is subject to different calamities. If your car gets damaged by a natural disaster, you can file a car insurance claim to cover the cost of repair and parts replacement—that is, if these situations are specifically detailed in your policy.

🚗 Damage Due to Events Caused by Men

Someone might have smashed the windows of your car as a prank. Or your neighborhood might be frequented by petty criminals who vandalize cars. If your car has been damaged by any malicious personalities, you can file a car insurance claim to keep yourself from using your own money when fixing the defilement.

What if your vehicle is carnapped? If theft is covered in your policy, you can file a claim so that the insurer will pay you the amount of your lost car’s fair market value.

8 Types of Car Insurance Claims in the Philippines

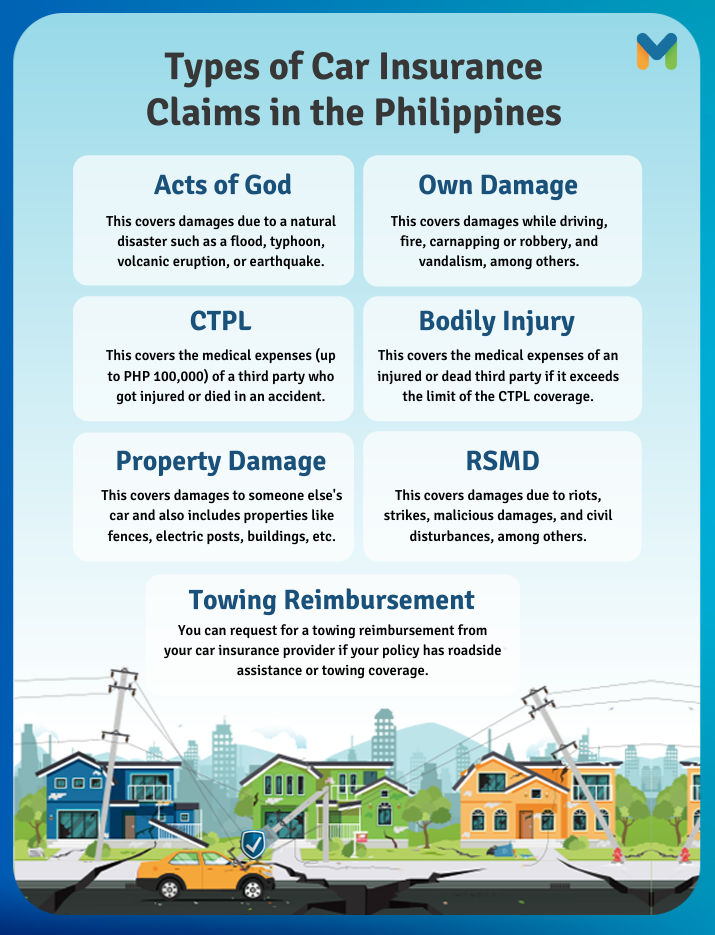

Now that you know various situations that require you to file a claim, you can delve into the different types of car insurance claims. After reading this section, check your car insurance policy to see its true extent and identify the missing coverage you need.

👉 Acts of Nature Claim

The Philippines is no stranger to natural calamities. If you acknowledge this reality, get an Acts of God or Acts of Nature (AON) coverage. If your vehicle gets damaged due to a natural disaster such as a flood, typhoon, volcanic eruption, or earthquake, you can file for an Acts of God car insurance claim.

However, some car insurance policies with an AON add-on don’t cover flooding, so check your policy first before making a claim.

Also, remember that the claim is valid only if the event happened suddenly or inevitably. Your policy won't cover car damage caused by your own negligence, including driving in a flooded or landslide-prone area even if you know it’s dangerous.

👉 Own Damage Claim

Own damage is the type of claim for when a vehicle (with a comprehensive car insurance policy) gets damaged due to a collision with another car, the gutter, an electric post, or anything else that causes damage while driving under normal and legal conditions.

What you can and cannot make a claim for depends on your car insurance coverage. Most comprehensive car insurance policies in the Philippines don’t allow an own damage car insurance claim for car damage caused by a flood or any natural disaster (unless your policy has an Acts of God coverage), among other things.

How to Claim Insurance for a Car Accident or Scratches in the Philippines

Planning to make a car insurance claim for own damage? Prepare and submit these requirements to your provider:

- Filled-out car insurance claim form

- Police report or notarized affidavit of the incident (Or a traffic-accident investigation report) only if the incident caused car damage and happened on a public road in Metro Manila, Metro Cebu, or Metro Davao)

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license

- Photocopy of car registration documents (OR and CR)

Read more: What Happens If I Stop Paying My Car Insurance?

👉 TPL Claim

When you make a claim under your Compulsory Third-Party Liability (or TPL) policy, you’re requesting your car insurance provider to pay for the medical expenses (up to the limits of ₱100,000) of a third party who got injured or died following an accident caused by your car.

This doesn’t cover the driver and any passenger in your car during the incident, as well as damage or loss to the vehicle and other properties of the third party.

How to Claim TPL Insurance in the Philippines

The process of how to claim TPL insurance in the Philippines varies, but providers generally have the same requirements. Send these to your car insurance provider if you're making a TPL claim:

- Filled-out car insurance claim form

- Police report or notarized affidavit of the incident

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license

- Photocopy of car registration documents (OR and CR)

- Medical certificate

- Official receipts of medicines and treatment

- Police sketch plan

- Notice of claim from the third-party claimant or insurance company

If the accident led to the death of the third party, these additional documents are required:

- Death certificate

- Photocopy of the valid ID of heirs or claimant (for third-party death claim)

- Funeral bills and receipts

👉 Excess Bodily Injury Claim

If your car insurance policy has excess bodily injury coverage, you can file a claim to pay for the third party’s medical expenses exceeding the ₱100,000 limit under the TPL coverage.

As with the TPL, making a claim for excess bodily injury doesn’t cover the driver and any passengers of the car involved in the accident.

What are the Requirements for an Excess Bodily Injury Insurance Claim in the Philippines?

- Filled-out car insurance claim form

- Police report or notarized affidavit of the incident

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license

- Photocopy of car registration documents (OR and CR)

- Medical certificate and medical bills

- Official receipts of medicines and treatment

- Police sketch plan

- In case of death: Death certificate and funeral bills

- Notice of claim from the third-party claimant or insurance company

👉 Third-Party Property Damage Claim

You can make this type of claim if you damage someone else’s car while driving your own normally and legally, as long as you have a comprehensive insurance policy.

It also includes damage to properties such as fences, electric posts, buildings, and other structures your car may hit during an accident.

Third-Party Property Damage Insurance Claim Procedure in the Philippines

To make a claim for third-party damage, submit these documents to your car insurance company:

- Filled-out car insurance claim form

- Police report or notarized affidavit of the incident

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license of the insured and third party

- Photocopy of car registration documents (OR and CR) of the insured and third party

- Police sketch plan

- Notice of claim from the third-party claimant or insurance company

- Certification of No Claim from the third-party insurance company

- Proof of ownership of the third-party property (for non-vehicle damage)

👉 RSMD Claim

-Jun-26-2023-09-06-08-8972-AM.png?width=674&height=449&name=Pics%20for%20blog%20-%20600x400%20(4)-Jun-26-2023-09-06-08-8972-AM.png)

RSMD stands for riot, strike, malicious damage, and civil disturbance. In case your car gets damaged due to any of those events, you can file for an RSMD claim.

What are the Requirements for an RSMD Claim in the Philippines?

- Filled-out car insurance claim form

- Police report or notarized affidavit of the incident

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license

- Photocopy of car registration documents (OR and CR)

👉 Towing Reimbursement Claim

You can request a towing reimbursement if your policy has roadside assistance or towing coverage, as long as you've coordinated it with your provider. You'll undergo the car insurance claims processing after you’ve availed of a tow service and paid the towing fee out of pocket.

What are the Requirements for a Towing Reimbursement Claim in the Philippines?

- Filled-out car insurance claim form

- Official receipt of the tow service

- Police report or notarized affidavit of the incident

- Photos showing the damaged portion and plate number

- Repair estimate

- Photocopy of driver’s license

- Photocopy of car registration documents (OR and CR)

👉 Theft Claim

Did your precious vehicle fall victim to carnapping or theft of parts? If you experience the loss of a car or car parts due to criminal acts, you can claim the fair market value—as long as it's stipulated in your policy.

How to Claim Insurance for Theft

If your car is stolen, file a police report immediately. Once done, contact your insurance provider. These documents may be required:

- Complaint Sheet, Alarm Sheet, and Certificate of Non-Recovery from the Traffic Management Group (TMG)

- Full set of vehicle keys

- Original copy of the car insurance policy

- Letter of Release from the bank (if applicable)

- Original copy of Cancellation of Chattel Mortgage (if applicable)

Car Insurance Claim FAQs

The various types of car insurance claims each have a very technical nature. If you're confused, check out the most common questions below.

1. Why is my car insurance claim denied?

A denied insurance claim can be frustrating, especially if you need the cash pronto. But stop for a while and reassess your case.

Check out the following situations, as one of them may be the reason why the insurer rejected your claim:

- The damage to your car isn’t covered by your policy.

- Your insurance has lapsed.

- The insurer found out that you intentionally damaged your car.

- You submitted fake documents. This may be considered insurance fraud.

- Unauthorized repair is done to the car.

- The vehicle was already damaged even before the accident.

- You committed violations stipulated by your policy.

2. Is a family member, friend, or anyone who borrows and drives my car covered by insurance, too?

Generally, yes. When you lend your car, the person who drives it gets covered by the insurance. However, you must check first the conditions of your insurer, so you’ll know how to file a claim if the case involves the borrower.

3. What is a deductible?

The word “deductible” is often thrown around by insurance agents. No idea what it means?

Simply put, a deductible is the amount you’ll need to cover in case your car gets damaged or lost. You’ll need to pay this before the insurer covers the rest of the cost. This is also known as the participation fee.

4. I’m planning to sell my car. Can the insurance be transferred to the new owner?

Insurance policies are personal by nature. Your car insurance isn’t attached to your vehicle. In case of a change of ownership, you’ll need to create an endorsement document, so the insurance policy will be transferred to the new car owner.[3]

To facilitate the smooth transfer, you may want to consult your insurer before selling your car. Doing so will also help you brief the new owner about the mechanics of filing a claim should they decide to continue your insurance.

5. An animal damaged my car. Will my insurance cover it?

Yes, but there are some conditions. It depends on the type of coverage or insurer.

If your car gets damaged by a wild animal that’s beyond human control, you can file for an Acts of Nature claim. Some insurers, on the other hand, may consider the damage caused by an attacking animal a third-party property claim.

Final Thoughts

Understanding how the different types of car insurance claims in the Philippines work can be quite challenging. But you must know the basics at least, so you’ll have an idea of how to get the ball rolling in case you get involved in an accident.

To resolve the issue as quickly as possible, call your insurer right after the incident. If you’re physically safe, start documenting the damage.

Filing a car insurance claim doesn’t need to be difficult, though, especially if you bought your policy through Moneymax. Since Moneymax offers end-to-end car insurance services, you can easily file a claim through the website. This saves you a lot of time and spares you from stress.

Get a Free Car Insurance Quote!

Thinking of switching to a different car insurance provider? Below is a list of top companies and their features. Compare your options through Moneymax to find cheap car insurance with the coverage you need.

| Car Insurance Company | Maximum Total Sum Insured | CTPL Coverage | Own Damage & Theft Coverage | Acts of Nature Coverage | Death / Disablement Coverage |

|

FPG Insurance

|

₱4 million

|

✔️

|

✔️

|

✔️

|

|

|

Malayan Insurance

|

₱7.5 million

|

✔️

|

✔️

|

✔️

|

|

|

The Mercantile Insurance Corporation

|

₱5 million

|

✔️

|

✔️

|

||

|

OONA Insurance (formerly MAPFRE)

|

₱5 million

|

✔️

|

✔️

|

✔️

|

✔️

|

|

PGA Insurance

|

₱3 million

|

✔️

|

|||

|

SGI Philippines

|

₱5 million

|

✔️

|

✔️

|

✔️

|

|

|

Standard Insurance

|

₱5 million

|

✔️

|

✔️

|

✔️

|

✔️

|

|

Stronghold Insurance

|

₱3 million

|

✔️

|

Sources:

- [1] Minor infra damage in Calatagan due to quake (Philstar, 2023)

- [2] PNP, UN official discuss road safety measures amid alarming PH fatal accident data (Manila Bulletin, 2023)

- [3] Buyer of Secondhand Vehicle Beware: No Endorsement, No Insurance Claim (Manila Times, 2020)