UnionBank is one of the most trusted financial institutions in the Philippines, thanks to their reliable consumer banking products like savings accounts and loans. The bank is also known for its wide range of credit cards.

UnionBank credit cards offer a lot of features and benefits. Among its most exciting features are longer credit terms, flexible monthly payments, an installment program with 0% interest, and shared credit card access with family and friends. Its credit cards also offer exclusive discounts on dining and shopping.

So if you want dibs on leisure-specific perks, a credit card from UnionBank makes a good choice. Here's how to apply for a UnionBank credit card in the Philippines.

How to Apply for a UnionBank Credit Card in the Philippines in 2025

Follow this easy three-step guide for your UnionBank credit card application.

Step 1: Check If You’re Eligible for a UnionBank Credit Card

-Jul-13-2023-07-04-05-8515-AM.png?width=624&height=416&name=Pics%20for%20blog%20-%20600x400%20(11)-Jul-13-2023-07-04-05-8515-AM.png)

Before you proceed with your application, make sure you meet the UnionBank credit card eligibility requirements:

👉 UnionBank Credit Card Application Requirements

- Must be 18 to 70 years old

- With accomplished application form

- With a valid government-issued ID bearing your photo and signature

- With proof of income (any of the following):

- Income Tax return (ITR) or Certificate of Compensation Payment and Tax Withheld

- Certificate of Employment or Employment Contract

- Latest three-month payslips

- BIR Form 2316

- Proof of pension

- Copies of Bank Statement of Account (SOA) from another bank for the last three months

- For foreigners: Alien Certification of Registration or its equivalent document

Step 2: Choose the Right UnionBank Credit Card for You

Not all UnionBank credit cards are created equal. Each has its own set of features and functions that suit specific groups of people based on their needs and priorities. With that, you have to take your time determining first which of these credit cards is the right one for you.

Learn the functions, similarities, and differences of these credit cards so you can pick the card that allows you to manage your payments properly. Here are some of your top options:

📌 UnionBank U Visa Platinum

- Annual fee: No annual fees forever

- Interest rate: 3%

- Minimum monthly income: ₱15,000

- Rewards: 10% rebate on interest charges

If you want to get a credit card but are intimidated by annual fees and other charges, check out the UnionBank U Visa Platinum. This card doesn’t have annual fees, late payment fees, and overlimit fees. Plus, you get a 10% rebate on interest charges when you pay at least the minimum amount due on or before the due date.

📌 UnionBank Rewards Credit Card

- Annual fee: ₱2,500 (Free for life if you apply until December 31, 2025, and meet the minimum spend requirement)

- Interest rate: 3%

- Minimum monthly income: ₱15,000

- Rewards:

- 1 point per ₱30 spend

- 3x points for shopping and dining in the Philippines and overseas

- Non-expiring points can be redeemed for cash credits, gadgets, merchandise, and more

Enjoy waived annual fees for life and maximum rewards just for U! With a UnionBank Rewards Credit Card, you can quickly and easily rack up points. Triple your non-expiring points when you use this card for shopping and dining transactions.

If you qualify for UnionBank's no annual fee promo, you can save ₱2,500 per year on annual membership fees!

Related:

- Get More Rewards: How to Earn Credit Card Points Quickly

- Time to Reap the Rewards: How to Use Your Credit Card Points

📌 UnionBank Cash Back Visa Platinum

- Annual fee: ₱4,500

- Interest rate: 3%

- Minimum monthly income: ₱15,000

- Cash back:

- Up to 6% rebate on supermarket purchases

- Up to 2% cash back on Meralco bill payments through UnionBank Online

- 0.20% cash back on all other purchases

If you plan to use your credit card for essential spending, get the UnionBank Cash Back Visa Platinum. Get rebates of up to 6% on your groceries, up to 2% on Meralco payments, and 0.2% on other transactions. With this cash back system, you can save as much as ₱15,000 per year.

Plus, your cash back won't expire. Redeem them whenever you want to.

📌 UnionBank PlayEveryday

- Annual fee: ₱1,500

- Interest rate: 3%

- Minimum monthly income: ₱30,000

- Rewards: 1 point per ₱10 spend

The bank describes its PlayEveryday credit card as a tool that makes adulting activities fun. Indeed, UnionBank's gamified rewards system is for cardholders who take rewards hunting very seriously.

Collect points by fulfilling seemingly mundane banking activities.[1] For example, setting up a PlayEveryday profile will give you 500 points. Spending via your PlayEveryday credit card will give you 1 point for every ₱20 spent. Making a referral is equivalent to 300 points. You get the drift.

📌 UnionBank Lazada Credit Card

- Annual fee: ₱3,000

- Interest rate: 3%

- Minimum monthly income: ₱30,000

- Rewards:

- 6x Lazada Credits for every ₱200 spent on the app

- 1 Lazada Credit for every ₱200 spent on other purchases and transactions

Love shopping online? The UnionBank Lazada Credit Card is your sulit shopping companion.

For every purchase worth ₱200 on the Lazada app, you’ll get ₱6 Lazada Credits. You also get access to exclusive discounts and privileges, such as free shipping and sale vouchers.

📌 UnionBank Go Rewards Gold Credit Card

- Annual fee: ₱3,000

- Interest rate: 3%

- Minimum monthly income: ₱15,000

- Rewards: 1 Go Rewards points for every ₱200 spend

Use the UnionBank Go Rewards Gold Credit Card to earn 1 Go Rewards point for every ₱200 spend. Accumulate points and use them to pay for your purchases at Robinson Retail brands!

Get a complimentary Go Rewards Black Membership, access to exclusive Go Rewards promos, and 3,000 Go Rewards points as a welcome gift once you get approved for this card.

📌 UnionBank Cebu Pacific Gold Credit Card

- Annual fee: ₱3,000

- Interest rate: 3%

- Minimum monthly income: ₱30,000

- Rewards:

- 1 rewards point for every ₱100 spend at Cebu Pacific

- 1 rewards point for every ₱200 spend

Are you a frequent flyer who’s always on the lookout for seat sales? You've probably heard of the UnionBank Cebu Pacific Gold credit card and how a lot of travelers swear by it. Cardholders receive early alerts on Cebu Pacific seat sales and earn points every time they use it.

Moreover, this credit card entitles you to free baggage allowance and priority boarding.

📌 UnionBank Cebu Pacific Platinum Credit Card

- Annual fee: ₱5,000

- Interest rate: 3%

- Minimum monthly income: ₱50,000

- Rewards:

- 1 rewards point for every ₱100 spend at Cebu Pacific

- 1 rewards point for every ₱200 spend

If you want a UnionBank Cebu Pacific credit card with all the bells and whistles, the Platinum variant is your way to go. Other than earning you points whenever you spend at Cebu Pacific and elsewhere, the UnionBank Cebu Pacific Gold gives you unlimited lounge access at Marhaba or PAGSS.

You also get free travel insurance of up to ₱10 million when you charge your airline tickets to your card.

📌 UnionBank Miles+ Visa Signature

- Annual fee: ₱5,000

- Interest rate: 3%

- Minimum monthly income: ₱30,000

- Rewards: 1 UB mile for every ₱30 spend

Another great credit card option for travelers is UnionBank Miles+ Visa Signature. If you're an avid traveler, you can rack up miles fast with this card. You also get free airport lounge access and ₱1 million worth of travel insurance as long as you charge your travel tickets to this card.

Read more: Fly for Free When You Convert Your Credit Card Points to Miles

📌 UnionBank Platinum Mastercard

- Annual fee: ₱3,000

- Interest rate: 3%

- Minimum monthly income: ₱50,000

- Rewards: 1% cashback on all your spends

Another great option for value-driven cardholders is the UnionBank Platinum Mastercard. Use it for everyday purchases to earn 1% cashback.

Plus, there are travel perks. Get free lounge access at NAIA Terminals 1 and 3. If you're wondering, "Can I use my UnionBank credit card abroad?" the answer is yes—this card is accepted at over a million establishments around the globe.

See also: Why Get Another Card: Is Having Multiple Credit Cards Good or Bad?

Step 3: Fill Out the UnionBank Online Credit Card Application Form

Before proceeding with the application process, make sure you have all the UnionBank credit card requirements ready (refer to the list above). For your convenience, we recommend that you apply online.

In fact, you don't have to leave this website—you can easily apply through Moneymax! Click Apply Now on your preferred card to start. See to it that the details you input are accurate and up-to-date to avoid delays and problems down the line.

Wondering how to apply for a credit card in UnionBank online, or how to do so via the UnionBank app? You'll have to go to UnionBank’s Credit Card page on their website,[2] choose your preferred card, and provide the pertinent information.

With the online mode of application, there’s no need to fall in line at the bank. But if you want to get things done in person or learn more about UnionBank credit cards, you can always go to a UnionBank branch and submit your requirements.

Better yet, contact UnionBank to see if they can schedule a meeting. Here are the contact details:

- Metro Manila: (+632) 8841-8600

- PLDT Domestic Toll-Free: 1-800-1888-2277

- International Toll-Free: (IAC) + 800-8277-2273

- Email Address: customer.service@unionbankph.com

How to Apply for a UnionBank Credit Card: FAQs

Still got some questions regarding UnionBank credit card application? Find the answers below:

1. How long does the processing time and approval take for UnionBank credit card applications?

Excited to get your new credit card? Remember, the UnionBank credit card approval days are usually between 12 and 14 days.

2. How can I check my UnionBank credit card application status in the Philippines?

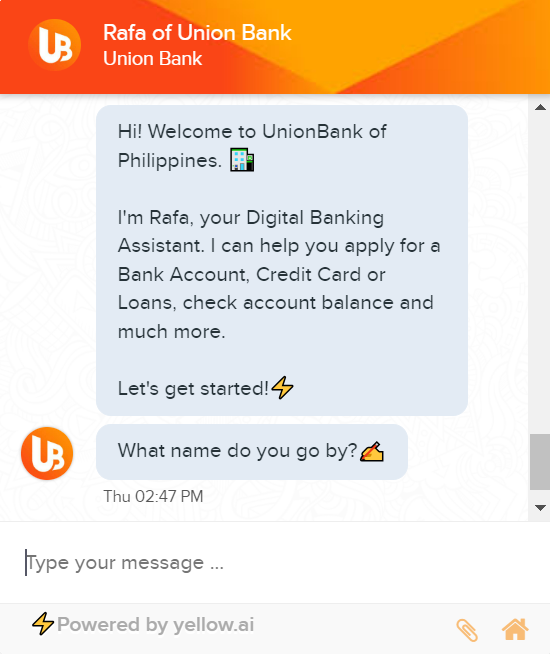

Just go to the UnionBank website and click the UB icon found on the lower right side of the screen. A chat box will then pop up where you can talk to Rafa of UnionBank, the bank’s dedicated customer service chatbot.

Type Credit Card Application Status, then choose Principal. After that, input your application reference number.

Better yet, contact the UnionBank branch where you lodged your application. Use the bank’s directory to get the branch’s contact details.[3]

3. How to activate a UnionBank credit card?

As soon as the UnionBank credit card is delivered to you, activate it so that you can use the card right away. Card activation can be done through the UnionBank mobile banking app, which is available on the App Store and Google Play Store.

Here’s how to activate your card via the UnionBank app:

- Launch the app and tap Activate Card on the dashboard.

- Choose Credit Card.

- Input your UnionBank credit card number, date of your birth, and your card’s expiry date.

- You’ll then receive a one-time PIN (OTP) via your registered mobile number. Enter the PIN into the field. After that, your UnionBank credit card is already active and ready to use.

You can also activate your UnionBank credit card via the chatbot found on UnionBank’s website. Here are the steps:

- Go to UnionBank’s official website.[4] Then, click the chatbot icon.

- Type Activate My Credit Card.

- Choose Continue with Rafa and click Proceed.

- Enter your credit card number, date of birth, and your credit card’s expiry date.

- You’ll then receive a one-time PIN (OTP) via your registered mobile number. Enter the PIN into the field. This will confirm your card activation.

4. What are the uses of my UnionBank credit card?

The primary use of your UnionBank is for purchasing items both online and offline, here and abroad. However, it also comes with other uses and features, such as the following:

- In-house installment – You can pay in monthly installments when you withdraw cash using your credit limit, convert your straight retail transactions, or transfer balances from non-UnionBank credit cards.

- PayEasy – You can purchase items at 0% installment at one of UnionBank’s more than 7,000 partner merchants nationwide. Payment terms are up to 36 months.

- PayBill – With this feature, you can auto-charge your utility bills to your UnionBank credit card. You’ll only need to remember one due date for all your bills.

- Cash advance – If you’re in a financial bind, use your UnionBank credit card to withdraw cash from the ATM. Fees and charges apply.

- Share the credit line – You can do this via supplementary cards. Your family and friends can use your credit line and enjoy other UnionBank credit card features. Take note that supplementary cardholders must be at least 14 years old.

- Access exclusive discounts and offers – Your UnionBank credit card lets you enjoy discounts with the bank’s partner merchants. As of this writing, you can avail of this perk from MetroMart, Designer Blooms, Shiseido, Burger King, Cafe France, Two Seasons Boracay Resort, and Savoy Hotel Boracay, among others.

- Get insurance – With your UnionBank credit card, you can get an affordable 4-in-1 insurance policy via U-Life. Coverage includes life, accidental, critical illness, and hospitalization.

6. My UnionBank credit card application is rejected. What should I do?

This is a frustrating thing to happen, but know that it’s not the end of everything. You can try applying again, but not too soon. Give it at least three months before you apply again.

Know the common reasons behind credit card application rejections. That way, you’ll be prepared for your next application. Here are some of them:

- You have a bad credit score.

- You have applied for a high-tier credit card despite having a low income.

- The details of your application are incomplete and inaccurate.

- You have unpaid credit card balances.

7. How to increase the chances of my credit card application getting approved?

If you want to make a good impression and have your application approved, here are some of the things you need to do:

- Be a responsible borrower – This means paying your bills on time. Doing so will increase your credit score. In turn, the bank will consider you a trustworthy and responsible cardholder.

- Stay employed – This will show that you have a steady source of income and will be able to cover recurring bills. If you’re self-employed, gather all your documents that prove your business is stable.

- Consider getting an entry-level credit card – This especially applies to credit card newbies or those with a relatively low income. Credit cards usually have an income requirement. If you don’t meet it, your application will likely be rejected.

- Check your documents before submitting them – Inconsistencies and inaccuracies in your documents can cause delay and even rejection. Double-check your documents before submitting them to the bank.

Final Thoughts

UnionBank has a wide range of credit cards that suit different clients, from lifestyle mavens to value-driven consumers. To find the best one for you, compare credit cards and choose wisely.

The process of how to apply for a UnionBank credit card in the Philippines is easy when you already know what you want and prepare your requirements beforehand. But if you want to know more about how you can use or maximize your credit card, feel free to browse our articles. You may also check out our application guides for other credit cards.

Haven't chosen a UnionBank credit card yet? Compare some options easily below:

|

Credit Card

|

Annual Fee

|

Minimum Annual Income Requirement

|

Key Features

|

|

Free for life

|

₱180,000

|

|

|

UnionBank Rewards Credit Card

|

₱2,500

|

₱180,000

|

|

|

UnionBank PlayEveryday

|

₱1,500

|

₱360,000

|

|

|

UnionBank Lazada Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Go Rewards Gold Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Cebu Pacific Gold Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Cash Back Platinum Visa

|

₱4,500

|

₱180,000

|

|

Sources:

_1200x628_CTABFI.png?width=600&height=314&name=UB_CC_U_Visa_-_Generic_1_(Dec_2024)_1200x628_CTABFI.png)

_1200x628_CTA_Blog.png?width=600&height=314&name=UB_CC_Rewards_-_Generic_1_(Dec_2024)_1200x628_CTA_Blog.png)

_1200x628_CTA.png?width=600&height=314&name=UB_CC_Cash_Back_-_Generic_1_(Dec_2024)_1200x628_CTA.png)

__1200x628__CTA.png?width=600&height=314&name=UBP_CC_Generic_Ad_-_Lazada_(Nov_2023)__1200x628__CTA.png)

_1200x628_CTA.png?width=600&height=314&name=UB_CC_Miles%2B_Generic_3_(Jan_2025)_1200x628_CTA.png)